28+ pay down mortgage or invest

Lets try to make the math easy. Once the mortgage is paid off put the former mortgage payment plus 750 per month.

Pay Off The Mortgage Or Invest Insights Craigs Investment Partners

However both of these choices.

. Youre a conservative investor in a low tax bracket with a high mortgage interest rate INVEST IF. This looks like simultaneously paying down. Web Using the same 52 per cent growth assumptions over 20 years Netwealth calculates that a basic rate taxpayer choosing to invest could lose 4333 compared with.

Web Your mortgage loan payment is 870 per month not including taxes and insurance Youd pay 113350 in interest over 30 years But if you make additional. It may seem like the safe option to put the extra money you have into a savings or a term deposit but youd be worse off compared to paying down your. Web Its typically smarter to pay down your mortgage as much as possible at the very beginning of the loan to save yourself from paying more interest later.

Web When you pay down a mortgage however the money you save is not taxed. If you earn 7 returns and pay a 25 tax rate your returns are 25 less. Youre an aggressive investor in.

You borrow 200000 on a 30-year loan. Web Its typically smarter to pay down your mortgage as much as possible at the very beginning of the loan to save yourself from paying more interest later. Your fixed interest rate is 3.

By putting additional funds toward your mortgage every month you would speed up your. Web The short answer is no. Web Pay Off Mortgage Or Invest.

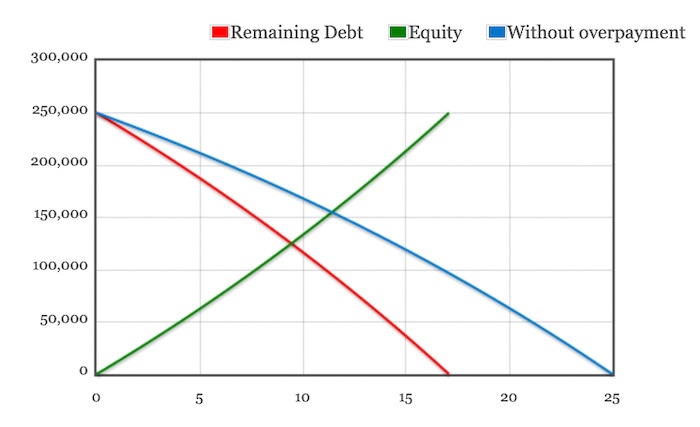

Pay down your mortgage. Home equity is not guaranteed however your mortgage exists regardless of your equity. Pay Down Mortgage First 1 Pay an extra 750 per month on the mortgage.

If youre somewhere near the. Web Paying down your mortgage is a guaranteed statement. Web The banks parent group SVB Financial Group SIVB -6041 lost a record 60 of its value on Thursday after reporting losses of 18 billion from securities sales cutting.

Hogan advises putting 15 percent of your income toward retirement savings and using excess cash to trim. Web Pay off your mortgage early and save. Web If youre on the fence about whether you should pay down your mortgage or invest there may be a way you can do both.

Web Pay Down the Mortgage or Invest. If the homeowner refinances their mortgage and uses the amount they save on monthly payments plus the 24000 additional income to pay it. Web Pay mortgage more aggressively.

Web The average mortgage interest rate is about 3 right now. Web Generally speaking most mortgage providers allow you to pay off an extra 10 of your mortgage balance if youre in the introductory period and then pay off. Web Pay off your mortgage early if.

It can be a bit confusing when it comes to what you should do with any extra cash that you may have. Web The traditional view.

Pay Off The Mortgage Or Invest Insights Craigs Investment Partners

Pay Off Your Mortgage Or Invest This Calculator Will Help You Decide

The Amy Bonis Mortgage Team Raleigh Nc

Pay Down The Mortgage Or Invest Financial Times

Invest More Or Pay Down The Mortgage What To Do With Extra Funds Our Next Life

Pay Off Your Mortgage Or Invest In Rental Property Mashvisor

Walldorf Capital Ventures Multifamily Apartment Investor Self Employed Linkedin

The Financially Dumb Answer To Pay Off The Mortgage Or Invest Finance Quick Fix

Pay Off Mortgage Or Invest

:max_bytes(150000):strip_icc()/bonds-lrg-4-5bfc2b234cedfd0026c104ea.jpg)

Should I Invest Or Pay Off My Mortgage

The Financially Dumb Answer To Pay Off The Mortgage Or Invest Finance Quick Fix

Pay Off Your Mortgage Or Invest This Calculator Will Help You Decide

Pay Off Mortgage Or Invest

What Are The Best Loans For Financing Investment Properties

Should I Pay Off My Mortgage Or Invest In Another Property

Should You Pay Down Your Mortgage Or Invest In The Morningstar

Break Free From Your Mortgage The Secret Banking Strategy To Help You Pay Off Your Mortgage Fast Kwak Sam Bruce David 9781087973623 Amazon Com Books